There is a lot of hype around the SBA’s EIDL (Economic Injury Disaster Loan) plan for small businesses. Aside from the pervasive fraud riddling the system and draining the pool for worthy recipients, there is still a “buzz” about the seemingly “free money” offering for COVID recovery. In my experience working with small business owners, the attraction seems to be like a lure to a fish: it’s all sparkly and shiny, but when you take hold and bite into it, it locks you in. Literally. I believe that once you truly know all the covenant requirements you won’t see a shiny lure any longer, but just an old ball and chain. And there is nothing appetizing about that!

Read the whole loan agreement

The Trojans learned their lesson when they accepted a gift from the Greeks, and we all know how that turned out. Same thing applies with our government offering a “too-good-to-be-true” deal for small businesses. When you look closely at what you’re agreeing to, you may see things as more restrictive and costly than you originally anticipated. The loan is filled with covenants, and the 30-year term alone spawns concern.

Why would you want a business loan to potentially follow you into your retirement?

Break it down

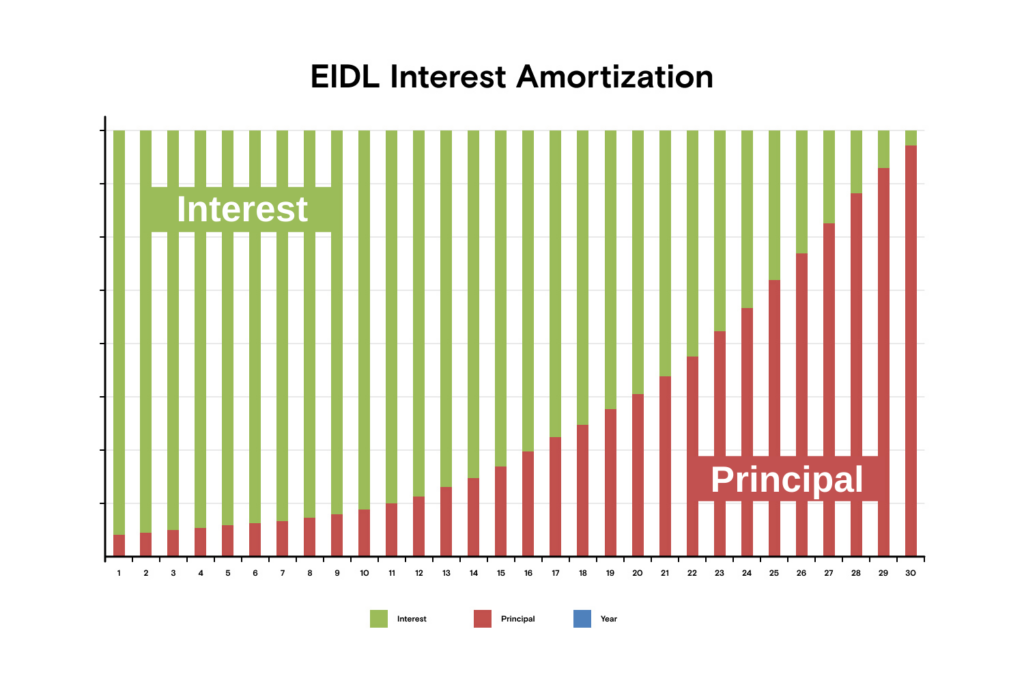

If you take out a $500K EIDL loan, you will pay $315K in interest over the life of the loan ($2,400 monthly payment including principal and interest).

https://www.nav.com/wp-content/uploads/2020/07/SBA-EIDL-LOAN-DOC-info-retracted.pdf

That’s over 60% of the value of the loan not including the added expense of maintaining the loan in order to avoid a default (more on that below). The loan matures like a mortgage, where most of the interest is paid over the first 10 years. Regardless of the deferment period, interest will still accrue. Not to mention, the SBA mandates that the loan can only be used for working capital purposes, which excludes items like expansion or capital expenditures. While cashflow for payroll is applicable, it is not the only need for most businesses who need capital to grow.

Also important to note, if you have a 5-10 year plan to sell your business, you’ll have to run it by the SBA for approval once you agree to their terms for the EIDL. You are officially locked into a partnership with the SBA upon signature for this program. What you’re also locked into is an SBA lien on your business until the loan is completely paid off, which can complicate your ability to qualify for bank financing in the future as a bank will require first position as well.

Superfluous requests

Some of the covenants that stuck out to me as egregious in the loan agreement are tied to “at the borrower’s expense.” Stipulations such as saving and itemizing receipts, invoices, canceled checks and contracts for 5 years prior and within 3 years of maturity without any definite time frame for request to produce seems excessive to say the least. The SBA doesn’t specify the frequency of the requests either, only that it is your responsibility to ante up, and if you do not keep accurate records of such, be prepared for legal recourse. Most GovCon business leaders aren’t running a business by day and moonlighting as a bookkeeper by night. So, if you’re not paying someone to stay on top of the above referenced documents, you could find yourself in an SBA audit, at your expense.

The SBA also reserves the right to request financial documents: operating statements, insurance coverage (hazard insurance is an added requirement for the entire term of the loan and must cover the total amount borrowed), tax returns, earnings and other compensation records, and stock purchase/options, at any time for the duration of the 30-year term. These requirements will force your business to maintain records far beyond the norm to avoid audits or legal recourse.

Business just got personal

Essentially this program will make you partners with the SBA until your debt is paid in full. Your agreement is like a prenup, and you will be forced to share your business and personal earnings upon request, at any time. That’s right. This loan requires not only excessive information sharing about your business finances, but will also require you to submit any changes to your personal assets including requests for inspection to and audits of your personal collateral as well, at your own expense.

It’s important to note that the SBA secures their loan with your personal assets, which remains active throughout the term of the loan. What this means is that you will not be permitted at any time, without SBA approval, to distribute any of your personal assets.

The biggest catch

If at any time you violate the terms of this agreement, the loan is immediately placed in default, regardless of whether the SBA notifies you of said default. This means the SBA can come for the entire amount left on the loan and seize all collateral used to secure the loan to cover the default. Your assets can be claimed before you are even aware of the default status. Hook, line and sinker.

The above referenced covenants are only a few of many, many more. The choice is yours. It may benefit you to research other options for alternative financing that don’t involve a marriage of such like this one does. Too much intimacy with government funds commingling in your daily operations will require a lot of oversight and even more in additional fees at the borrower’s expense than any alternative financing.

So, if you are toying with looking this gift horse in the mouth, be prepared for the years of commitment and requirements foretold in its teeth. Be aware of all of your options for the same amount of cash flow access. You may find that the other options fit your needs better without all the hassle or commitment.