Part 2: The Big Lie – Interest Rates are not APRs

Running a government contracting company comes with many risks and rewards. One of the biggest risks can be a stall in cash flow due to slow payment by the government.

If your Company does not have a cash reserve and needs immediate access to working capital, the options are typically limited to (A) factoring or (B) a line of credit with a bank (if your company can qualify). If you’re considering factoring to expedite acquisition of funds, be sure to read the fine print as factoring brings along headaches, hidden fees, and leads to your contracting officer being pestered with calls and notices for collection of payment.

Due to its hidden fee structure, factoring is one of the most convoluted financing options available to government contractors. Factoring companies use the bait of a low Interest Rate to lure you in, knowing the actual cost (the APR or Annual Percentage Rate) is 2 – 3 times more than they are advertising.

As discussed in Part I, factoring allows companies to sell an unpaid invoice at a discount for immediate cash. All the fees are deducted from the residual payment you receive once the factoring company has collected payment of your invoice. But, how do you figure out how much you’re being charged? It’s almost impossible to understand because if you understood the actual rate you never would have signed up in the first place.

A factoring company will always quote you a low interest rate in their offer, but make sure to read the fine print because there are always hidden fees. Some are flat fees and others are variable each time you factor. These fees disguise the low interest rate quoted.

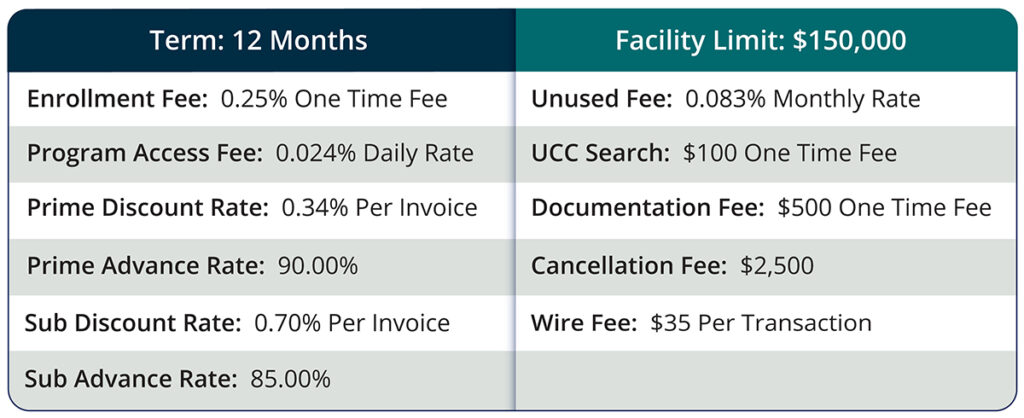

The following table presents a typical fee structure for a government contract factoring company:

Factor Pricing Proposed Terms

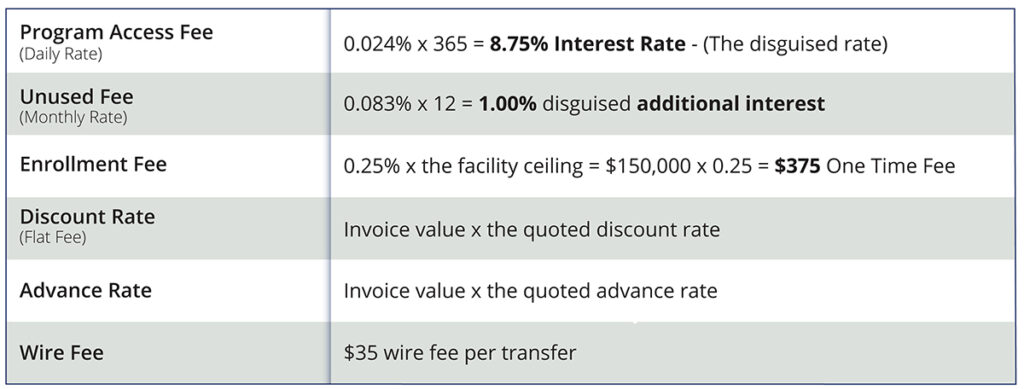

How to decipher each of the above terms:

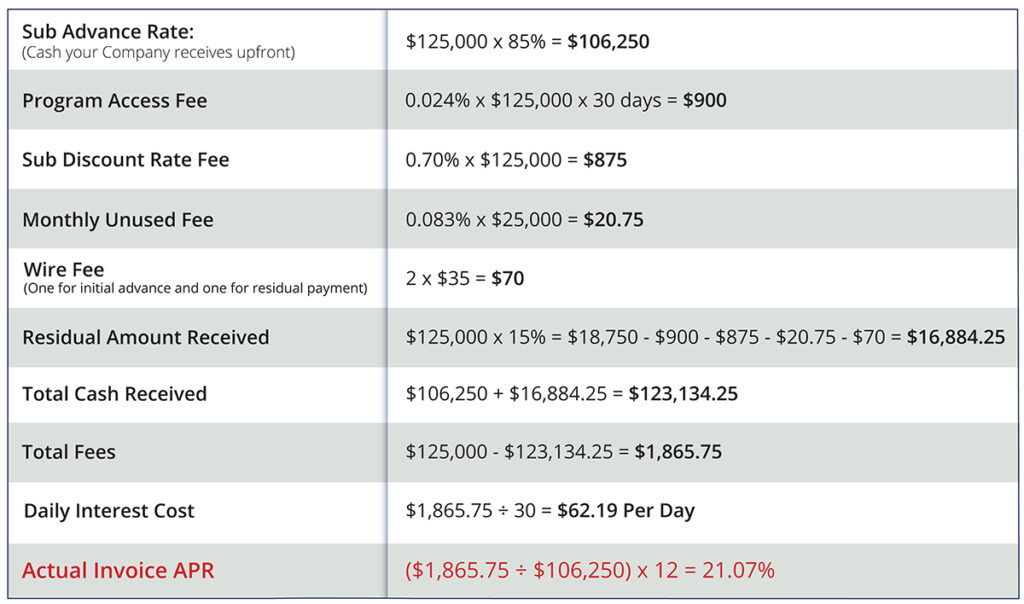

Let’s look at an example to understand how factoring interest differs from the actual APR:

In this example, a $125,000 Sub-contractor invoice is factored and outstanding for 30 days. Are you surprised? Your business is paying almost 2.5 times the quoted Interest Rate because of the hidden fees in the fine print. This estimate does not account for the initial setup fees for opening the factoring facility in the first place!

You wrote the proposal, you won the contract, and you are executing to the highest standards and you’re now paying 21.07% APR to a factoring company. But as part of the Big Lie, you were quoted an 8.75% interest rate! There must be a better solution?

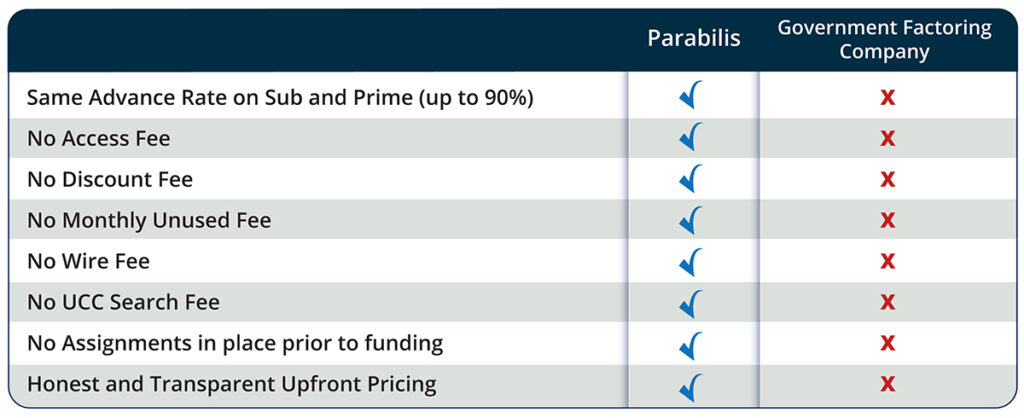

There is. A revolving line of credit will be significantly cheaper, allow you greater access to more cash up front, and can be in place faster than a factoring facility through a private lender like Parabilis. Parabilis charges a straightforward, transparent interest rate for all invoices and an upfront commitment fee to secure the funds.

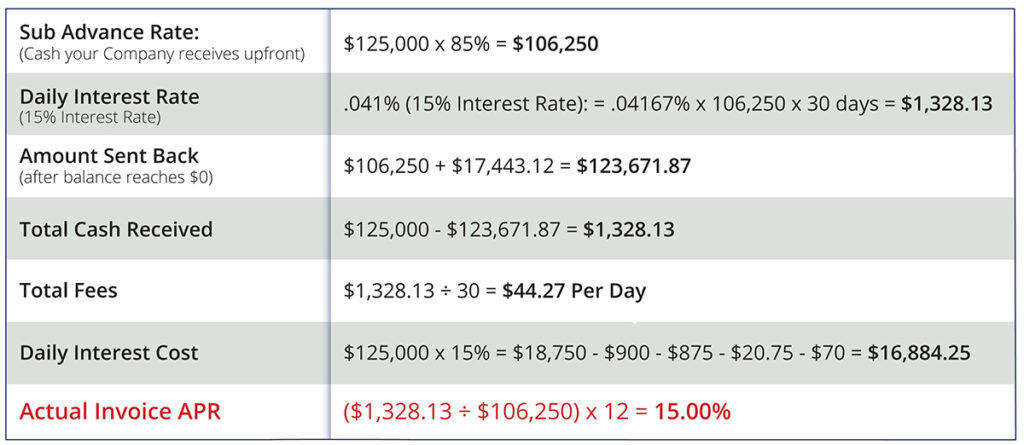

The same example, a $125,000 Sub-contractor invoice utilizing a Parabilis line of credit for 30 days.

The example above represents just one invoice a month. By switching from a factoring company to a private lender that provides a line of credit the annual savings would be ($62.19 $44.27) $17.92 per day or $6,540.80 per year. The larger the facility, the greater the savings.

A line of credit provides honest and transparent pricing. It creates a relationship of trust with your lender. Disguised fees can leave you feeling like you were manipulated and creates distrust as you wonder “What else is my factoring company not telling me?” The answer: Read the fine print.

Continue to The Perils of Factoring, Part 3.